POSITIVE PAY & ACH REPORTING*

Positive Pay: The ultimate defense against transaction fraud

Stay one step ahead of fraudsters, maintain regulatory compliance, and provide enhanced protection against unauthorized transactions for your commercial accounts. By offering Positive Pay, your financial institution can make transacting safe and simple.

Turn payment fraud prevention into a profit center

With our core and digital banking-agnostic Positive Pay Solution, we turn payment fraud prevention into a profit center, replacing outdated, paper-based processes with real-time alerts. Allow businesses to act quickly when fraud is attempted or when discrepancies arise in payments to prevent further losses and minimize the impact of fraudulent activities.

What is Positive Pay?

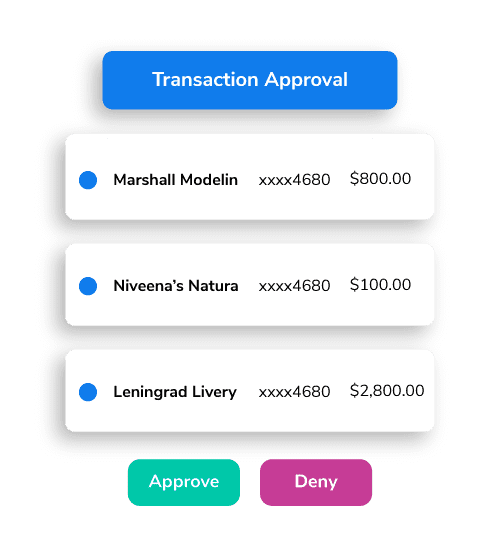

Positive Pay is a banking service that helps detect and prevent ACH and check fraud by allowing commercial accounts to monitor transactions against check issuance files and ACH criteria. Matching transactions are processed, while discrepancies are flagged for review, requiring approval or rejection.

Does it increase revenue?

Your organization can generate fee-based income by offering Check and ACH Positive Pay to business, commercial and corporate accounts willing to invest in advanced security and peace of mind. Our solution also simplifies enrollment of business users, which can lead to increased profits and user adoption.

Say goodbye to sleepless nights. Rest assured your transactions are secure.

Positive Pay for check & ACH

Give controllers, treasury professionals, and business owners control to protect their businesses. Positive pay for check & ACH helps commercial accounts prevent unauthorized ACH and check payments by sending alerts for quick authorization of transactions. Strengthen ties with businesses, increase profits for your financial institution, and minimize losses for your organization and commercial accounts.

ACH Returns & Notifications of Change

Promptly notify users of returned ACH transactions or incorrect payment details. Commercial accounts need current information and the option to export it in different digital formats. This is important for them to promptly respond and make necessary adjustments. Automating ACH NOCs and returns to originators saves time and protects against future volume increases in the back office.

EDI Translation

Translate complex Electronic Data Interchange (EDI) remittance information embedded in ACH transactions and automatically notify treasury management and other clients when payments arrive.

Commercial accounts can access and download banking EDI in various digital formats. These formats include 820, 835, PPD+ SSA, and Free Form addenda. By doing so, they can automate accounting processes and enhance operational efficiency.

Transaction Origination Security

Stopping corporate account takeover has been a major concern for financial institutions and their commercial accounts in recent years. Fraudsters often target wire and ACH payments, so these channels need extra protection.

Ensure that your organization is prepared for common attacks. You can do this by implementing a proactive plan. The plan should include wire and ACH verification as well as out-of-band authentication.

Positive Pay & ACH Reporting

Alkami is revolutionizing treasury management. FIs using this solution have experienced:

Stopped/Returned

Related Resources

Digital channel spending as a percentage of total IT spend up 3%; Chatbot deployment increased...

Alkami has known from its very inception that a diverse collective of backgrounds and talents...

Automated Clearing House (ACH) credit payments are an integral part of today’s financial transactions, playing...

Business Banking Solutions

Business Banking Solutions Data & Marketing Solutions

Data & Marketing Solutions Positive Pay & ACH Reporting

Positive Pay & ACH Reporting Who We Serve

Who We Serve